What Are the Most Expensive Construction Materials?

Construction material costs have risen recently, but which materials are most expensive?

In recent years, building materials prices have been on the rise, pushing the overall construction cost higher for countless projects. While the average annual increase of commercial construction costs hovered between 4% and 5% for several years pre-COVID, we’ve seen annual cost increases of 12%—or higher!—over the last few years.

The reason? For one, COVID-19 triggered a variety of supply chain problems.

At the height of the outbreak, high infection rates among port workers and shortage of shipping containers led to port congestion and major backups in places like Shanghai, New Jersey, Long Beach, and Los Angeles. Cargo depots were similarly affected, meaning purchasing new building materials was often a slow and expensive process.

While port congestion problems have mainly faded, other supply chain problems remain. For example, the war in Ukraine has impacted everything from food to fuel prices—and, by extension, construction materials prices. Additionally, though demand for housing is currently dropping, it had a massive spike during the pandemic, resulting in high demand and high prices for various building materials.

What Are the Most Expensive Construction Materials?

Most construction materials prices have risen over the past couple of years, but some are more expensive than others. Materials that have notably become more expensive include:

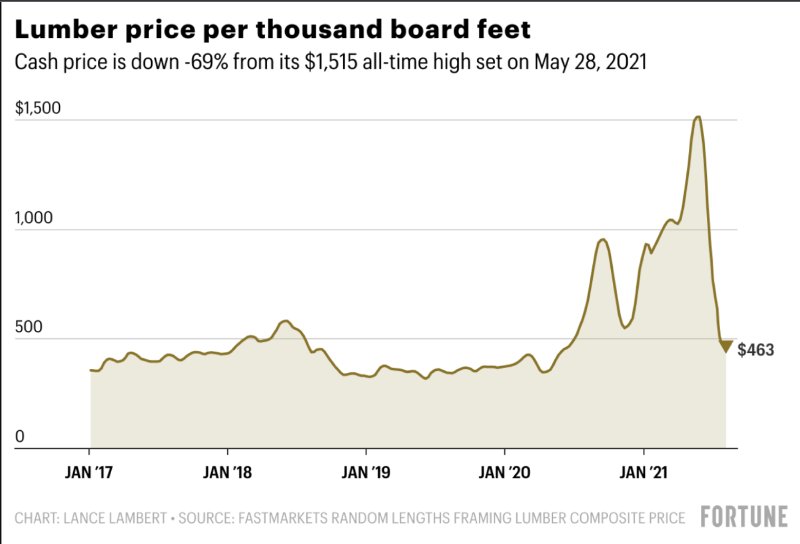

Chart from https://fortune.com/2021/08/12/lumber-prices-2021-chart-deals-price-of-lumber-wood-stores-august-update/

Lumber

When people think of extraordinary building material price increases, their mind often jumps straight to lumber. After all, lumber prices soared during the pandemic. Wholesale prices for plywood went from $400 to $1,5000 per thousand square feet, and other types of lumber experienced similar price increases.

There were several factors behind the drastic increase in lumber prices. For one, the spread of COVID-19 meant fewer workers in the forest products industry. Additionally, there was a shortage of workers at the ports, in the warehouses, and on the road, which only worsened the already limited supply of wood. On top of that, there was a significant spike in people spending money on home improvements during the early days of the pandemic, driving up lumber demand and prices.

Unfortunately, there was no relief in lumber prices from Canada, as their annual allowable cuts were decreased due to Mountain Pine Beetles attacking commercial lodgepole pine. What’s more, shipping constraints meant any lumber imports were slow to arrive.

Lumber prices dropped significantly in 2022, likely due to rising interest rates, and many are wondering, ‘Will lumber prices do down in 2023?’ Experts believe lumber prices will remain relatively low compared to these last few years and experience slight rallies as supply and demand change, but it’s impossible to say for sure.

Millwork

The price of millwork has followed a similar path to lumber—and it makes complete sense. If it’s more difficult and more expensive to obtain wood in the first place, millwork producers need to raise prices to continue making a profit. Everything from moldings to doors to panels has experienced price fluctuations in recent years.

To make matters worse, the millwork and woodworking industry’s worker shortage has continued, which has affected available supply and prices.

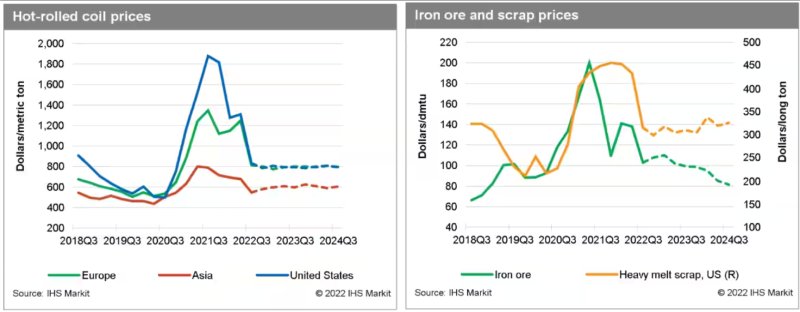

Charts from https://www.spglobal.com/marketintelligence/en/mi/solutions/steel-forecast.html

Steel

Like lumber prices, steel prices spiked during the pandemic. Fearing a recession or a depression, many steel mills shut off production. However, steel demand quickly rose. After all, people were stuck at home and wanted to buy everything from new refrigerators to grills to lawn mowers. Unfortunately, the steel mills weren’t prepared for the increase in demand. By July 2021, steel prices were up 200% compared to pre-pandemic pricing—and costs had been up 300% at one point.

There is good news, though. Steel prices decreased slightly in 2022, though they still remain much higher than pre-pandemic levels. It’s possible that steel prices could come down even further due to the housing development slowdown and increased mill production.

Cement and Concrete

According to global consultant Linesight, cement and concrete prices were up around 14% year-over-year in the third quarter of 2022. Cement and concrete prices were on the rise as a result of higher production and transportation costs. It’s also worth noting that sand, an essential ingredient for concrete, is going through a shortage and has rocketed in price.

Local problems have also impacted the cost of cement and concrete. For example, storm Uri in February 2021 caused many Texan cement manufacturers to shut down. This reduced the supply of cement and resulted in rising prices. Additionally, the Mississippi River had low water levels caused by a drought, which meant many barges were unable to move cement along the river.

As for what’s in store for 2023, it seems unlikely that cement and concrete prices will decline. After all, production and transportation costs aren’t likely to lower any time soon, and more supply chain problems may occur at any moment.

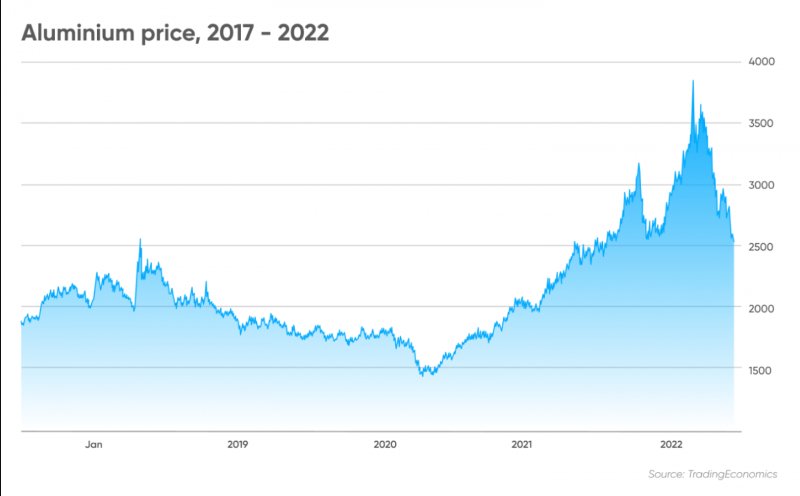

Chart from https://capital.com/aluminium-price-forecast

Aluminum

Aluminum, too, has had a rocky road. In early 2020, aluminum prices experienced record declines. Demand was down, while global economic activity significantly retracted. As a result, aluminum prices decreased.

By March 2022, aluminum prices were at their second-highest levels in a decade. After all, consumers were buying electronics, cars, and household appliances—all of which require aluminum—at alarming rates during the height of the pandemic. Additionally, strikes, COVID-19 restrictions, trading restrictions, power shortages, and rising energy prices meant that places like Australia, Guinea, Peru, Chile, and China had difficulty mining, refining, and shipping aluminum, which drove the price up.

To make matters worse, Russian imports were sanctioned, following the Russian invasion of Ukraine. However, come October 2022, aluminum prices fell by 36% due to a weak demand outlook. China’s industrial centers have been at a standstill due to their zero-COVID strategy, while the U.S. Federal Reserve’s interest rate hikes have impacted aluminum demand in the states.

Demand and prices will likely remain lower for 2023 but may rise in the coming years as work begins on President Biden’s infrastructure bill and electric vehicles become increasingly popular.

Plumbing

Given how the prices of metals like iron, steel, and copper have been increasing, it’s only natural that plumbing material prices have also skyrocketed. Shipping delays and labor shortages have also contributed to the cost change, and the trade war between the U.S. and China isn’t helping matters, either.

Examples of plumbing supplies that have recently undergone a price increase include faucets, piping, hot water tanks, furnaces, boilers, and fixtures. According to Co-President of Neptune Plumbing, Mike Wallenstein, PVC pipe costs went up 75%, PVC fittings were up 83%, and cast-iron pipes were 83% more expensive.

Paint Materials

In the wake of the pandemic, paint has become increasingly difficult to get a hold of and expensive. Between the raw material constraints, the supply chain issues, and the rapid increase in demand during the COVID-19 pandemic, paint has been in short supply—and prices have been accordingly high.

Additionally, a winter storm hit Texas, causing power outages and disrupting suppliers’ plants, and a deep freeze slowed petroleum production. What’s more, the global supply chain problems and climate change have caused delays and difficulties sourcing the pigments, resins, solvents, and additives necessary for creating paints. When combined with the rising architectural, industrial, and DIY demand, it’s hardly surprising that paint materials quickly shot up in price.

Despite the high prices of paint, sales increased rapidly during the pandemic. Paint buyers were undeterred—and though the pace of sales increases has been slowing down in recent months, it still remains robust. Most experts believe these paint prices are here to stay for a considerable amount of time.

Navigate High Construction Materials Prices with AMAST’s Help

Everything from COVID-19 lockdowns to supply chain disruptions to worker shortages to extreme weather events has reduced the supply of construction materials. At the same time, demand has soared. People were stuck at home for months, and many turned to home improvements and DIY to fill their time. Others decided it was the perfect time to build a new house. Either way, construction materials demand rose—and so did buildings materials prices.

Many contractors have raised their rates or accepted smaller profit margins to keep up with rising material prices. However, that’s not your only option. You can also try to source materials at a cheaper price. That’s where AMAST comes in.

AMAST’s online B2B marketplace is the perfect place to find materials and supplies at an affordable price. With over 400 vendors and 300,000 SKUs, AMAST is a one-stop shop for contractors searching for high-quality materials and products.

Not only can you easily compare prices on AMAST, but you can also get quotes from our vendors—no need to pay or commit! By giving us your material wish list, you can save time and energy and still get the best possible deal from local and nationwide vendors. AMAST users have cut construction costs by up to 15% and reduced order errors by 90%.

Join AMAST for free today to start finding materials and supplies and see everything we can do for you!